Depositing money into your bank account helps you build your savings, earn interest* and protects it from loss or theft. You can deposit cash and checks at a bank branch or ATM, or add funds to your prepaid card. If you’re depositing cash, check to see if the ATM offers envelopes (or ask your bank about them). Then prepare your cash and fill out the correct information as prompted by the ATM.

Cash

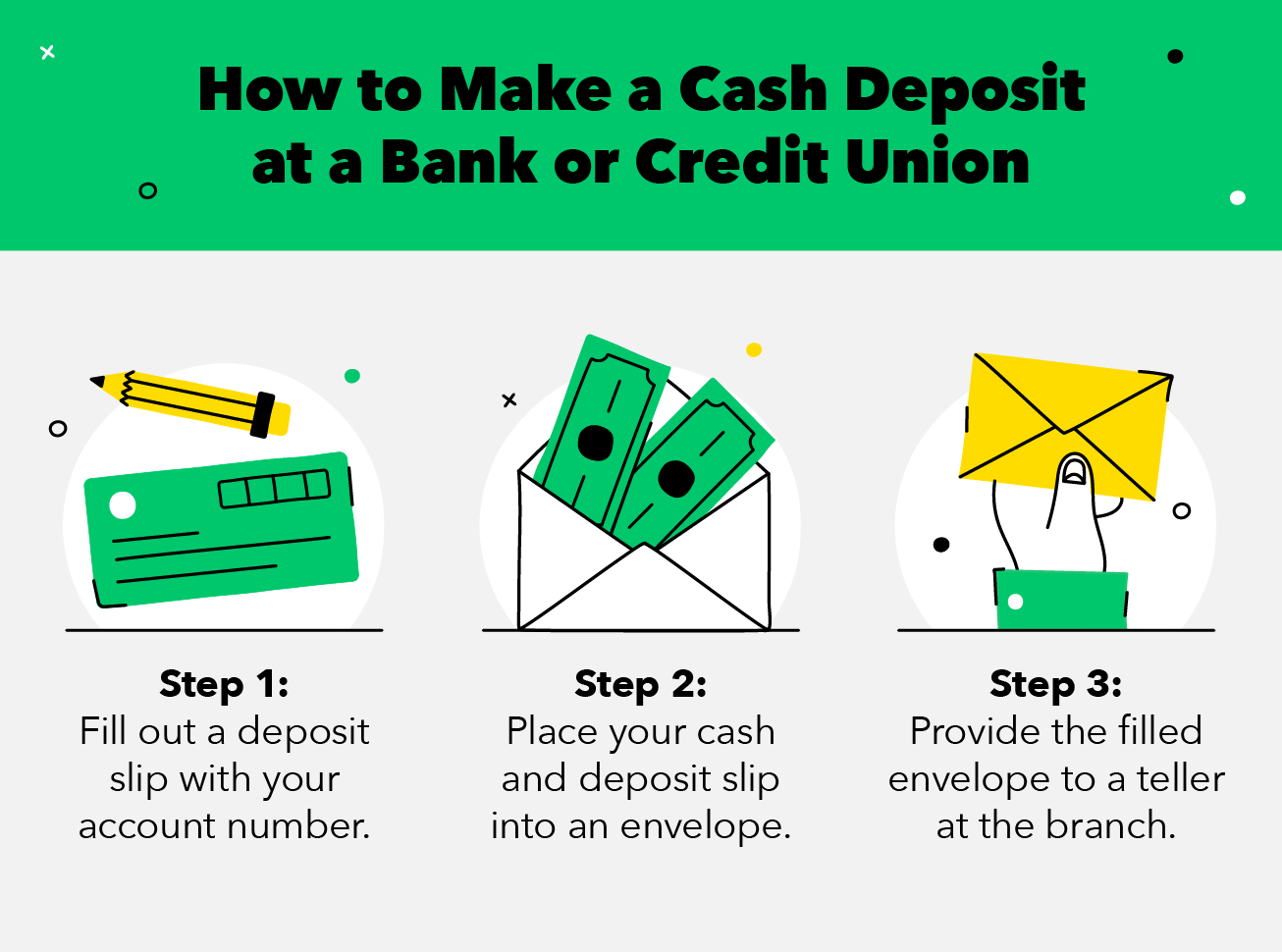

The easiest way to deposit cash is in person at a bank branch. This is also the most versatile option in terms of the types and dollar amounts of payments you can make at a time. The only drawback of depositing cash in this manner is that funds may not be available immediately. The amount of money you can deposit at a single time depends on your bank’s policies and anti-money laundering regulations. It is a good idea to check with your financial institution’s website or mobile banking app ahead of time to learn more about their guidelines for cash deposits. In many cases, your bank will not allow you to deposit more than $10,000 in cash per day.

Another way to deposit cash is at an ATM associated with your bank or credit union. These may offer fee-free deposits, and they can be helpful when you’re not able to visit a physical bank branch. To deposit cash at an ATM, insert your debit card and enter your PIN. Then select “deposit” from the ATM options and follow the on-screen instructions. If you’re depositing a stack of bills, check the machine to see if it provides envelopes and instructions for proper preparation.

Most ATMs will ask you for an account number and the date of the deposit, so have those ready in advance. It’s also a good idea to double-check the amount you are depositing to ensure that it is the correct sum.

Some banks partner with retail stores, such as CVS and Walgreens, to allow you to deposit cash at these locations using your mobile banking app and a debit card. Check with your bank to learn more about this option, and make sure to check the terms and conditions carefully, as these may include limits on the types and amount of payments you can make and when the funds are available. Alternatively, you can use a prepaid debit card to deposit funds at these kinds of locations. These cards offer additional advantages in terms of security and privacy, especially for people who want to avoid revealing their name and contact information.

Checks

A check is money that a bank or financial institution agrees to pay you. Often, it is drawn on your bank account and paid to someone else. The person who receives the check pays you back in cash or by transferring funds into your bank account. Depositing a check typically requires a valid form of identification. You can deposit a check at the bank in person, by mail, or through mobile banking. If you are depositing a check for someone else, it is a good idea to get them to sign a deposit slip with their account information, which makes it easier and less risky for both of you.

The simplest way to deposit a check is to visit your bank branch. You can deposit a check in person with a teller by presenting your ID and the check. Your bank will usually ask you to endorse the check on the back, and most banks have a line that says “Endorse here.” Make sure the person who signed the bottom of the check writes their name, address, phone number, and date in black ink. It is also a good idea to write “For mobile deposit only” or “For deposit only at [your bank name]” below the signature.

If you are using your mobile banking app to deposit a check, follow the instructions on the screen to log in and take photos of the front and back of the check. Most of the time, the banking software will automatically scan and upload the photo. You should keep the check until you receive a text or email stating that the funds have been deposited into your account.

If you have trouble with your mobile deposit, contact your bank to learn how to fix it. Your bank may also have an FAQ page that answers common questions about mobile deposits. In addition to being convenient, mobile deposit is also secure. The process is backed by encryption, and your information is kept private and secure at all times. The only drawback to mobile deposit is that it can be slow compared to visiting your bank in person.

Mobile Check Deposit

If your bank offers mobile check deposits, it’s a safe and convenient way to deposit checks from anywhere using your phone. It works by taking a photo of the front and back of the check, using technology similar to those used in scanning photos or documents onto your computer.

To use this feature, first make sure your phone is set up to take photos. You’ll need to have an external microphone if your phone isn’t capable of recording audio, and you’ll also need a memory card if your phone doesn’t have built-in storage. Then, go to your mobile banking app and locate the mobile deposit feature. Follow the prompts in the app to enter the deposit information and endorse your check, if necessary (check with your bank for instructions on how to properly endorse a check). Some banks limit the amount you can deposit through mobile deposit, so be sure your check falls within this range.

Once the deposit is entered and verified, you’ll typically be prompted to take a photo of the front of your check. Line up the image of your check with the frame provided and tap to capture it. Some apps may provide tips on how to get a better image, such as using a dark background or making sure the entire check is in view. After a successful picture is taken, the check information will display in the app and you’ll be able to submit your deposit.

The bank will process the deposit, which can take a day to a week depending on your bank’s policies and whether or not it has fraud detection processes in place. In some cases, the bank may decide to return the deposit if it appears suspicious or if there’s a problem with the images uploaded for processing. If this occurs, you’ll be notified through your bank’s mobile app or email and can visit a branch with the original paper check to get it resolved.

You can use mobile check deposit for personal checks, business checks and money orders, as well as government-issued checks such as tax refunds and stimulus checks. However, you’ll likely need to visit a branch or ATM to deposit cashier’s checks, traveler’s checks and other third-party checks.

Direct Deposit

Direct deposit is a safe and convenient way to receive money. It’s an option that’s usually offered by employers, but people can also use it to receive Social Security payments, pension checks, tax refunds, travel reimbursements and even money from family and friends. In addition, it’s an efficient option for small businesses and entrepreneurs to use, especially when paying employees.

To set up direct deposit, you’ll need to provide an organization with your bank account information. This typically includes your bank name and address, bank routing number, and your bank account number (or checking or savings). You may be asked to sign a form with these details or to attach a voided check. It’s important to verify the accuracy of this information before giving it to an organization. You can check your own bank account for this information, contact your bank by phone or log into your online banking account to do so.

Once an employer or other party starts to use direct deposit, the payment will be sent electronically from your bank to the payee’s bank. This is a much quicker option than sending paper checks, which can be delayed by mail or other factors. It’s also more secure than traditional payments because the money is not physically present. People cannot steal or alter checks, but digital payments are easily tracked in your banking transaction history.

Whether you’re sending or receiving a payment via direct deposit, it typically takes a few days to a few weeks to process. This is because the bank will bundle all of the payments together, package them up and send them to the Automated Clearing House (ACH) at regular intervals. Once the ACH has received the orders, it will credit the recipient’s accounts and debit yours accordingly.

If you want to make a quick, simple and secure deposit into someone else’s account, consider using a mobile payment app like Zelle. You’ll need the recipient’s phone number, name and bank account information to complete a Zelle transfer. This method works well if you want to surprise someone with a monetary gift, or if your meeting in person isn’t possible.